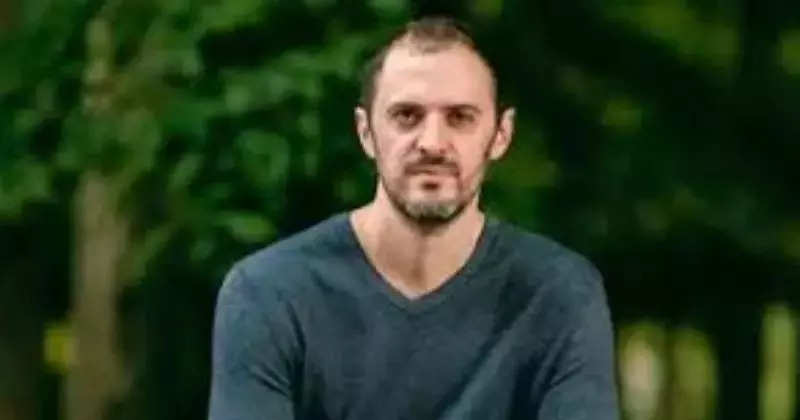

Hindenburg Research Founder Nate Anderson Under Investigation for Alleged Hedge Fund Collusion

Uncovering the Shocking Truth: Short-Seller's Secret Deals Exposed!

The world of finance is buzzing with a bombshell revelation! Renowned short-seller Nate Anderson, the founder of Hindenburg Research, is facing serious allegations of colluding with hedge funds. Court documents filed in Ontario, Canada, suggest a hidden network of deals that could shake the financial industry to its core. This isn't just about market manipulation; it's about uncovering a conspiracy of epic proportions.

The Canadian Connection

A Canadian portal has broken the explosive news, citing documents from the Ontario Superior Court of Justice. The documents detail a complex defamation lawsuit where Moez Kassam, the head of Anson Hedge Fund, admits to sharing research with multiple sources, including Hindenburg's Anderson. The implications are staggering; these seemingly independent short-selling reports could be part of a larger coordinated scheme.

Unraveling the Securities Fraud Allegations

Court documents paint a picture of possible collusion between Hindenburg and Anson. Preparing bearish reports without disclosing any financial connections can be a severe breach of securities laws, making this a serious SEC investigation. Short-sellers profit by driving down stock prices. They borrow shares, sell them, and later buy them back cheaper. The involvement of hedge funds adds a dangerous layer because they can amplify the downward pressure, magnifying the financial impact. It's all a complex puzzle. But this investigation could unravel a multi-billion dollar game.

The SEC Investigation and Its Implications

This isn't just some small scandal. The US Securities and Exchange Commission (SEC) takes market manipulation incredibly seriously. They investigate the actions of Hindenburg, aiming to unveil a possible elaborate game that aims to bring the stock markets to their knees. Such allegations of hedge fund collusion would send tremors through Wall Street. These high-stakes investigations could result in hefty fines, reputational damage, and criminal charges for Anderson and all those found to be involved.

Impact on the Market

If the allegations are proven true, this will shake up confidence and create an impact that ripples across the industry. Many investors now distrust financial reports. Therefore, full transparency is required to restore investor confidence in future market integrity and oversight.

What Happens Next? The Future of Hindenburg Research

As this story unfolds, many questions remain. What is the full extent of Anderson's dealings? How many other companies have been targeted as part of this alleged conspiracy? And most importantly, what will be the consequences for those involved?

The Fate of Hindenburg Research

Will Hindenburg Research survive this scandal? The short-selling firm's reputation is on the line, and the legal fallout could lead to significant financial ramifications. With regulatory authorities investigating potential wrongdoings, the uncertainty over its future hangs heavy in the air. One thing is clear: The implications for market regulators around the globe are profound. The future of Hindenburg Research hangs precariously in the balance. The ramifications on the credibility of independent research are likely severe.

Take Away Points

- The ongoing investigation into Nate Anderson and Hindenburg Research highlights the crucial need for transparency and ethical standards in the financial markets. Any collusion with hedge funds poses significant risks to the overall market integrity and the many individuals who have invested in the market.

- Investors need to be extra vigilant when considering market research, to discern authentic market trends from false ones generated by individuals with self-serving motives. There's a possibility that those individuals may not care about others' investment portfolios.

- This event serves as a stark warning to all investors, regulators, and participants in financial markets to be acutely aware of the risks associated with short selling and to fully comply with securities laws.

- The outcome of this investigation will greatly impact the future of short selling research and will possibly change market landscape globally. Transparency will be a significant step to help rebuild trust.