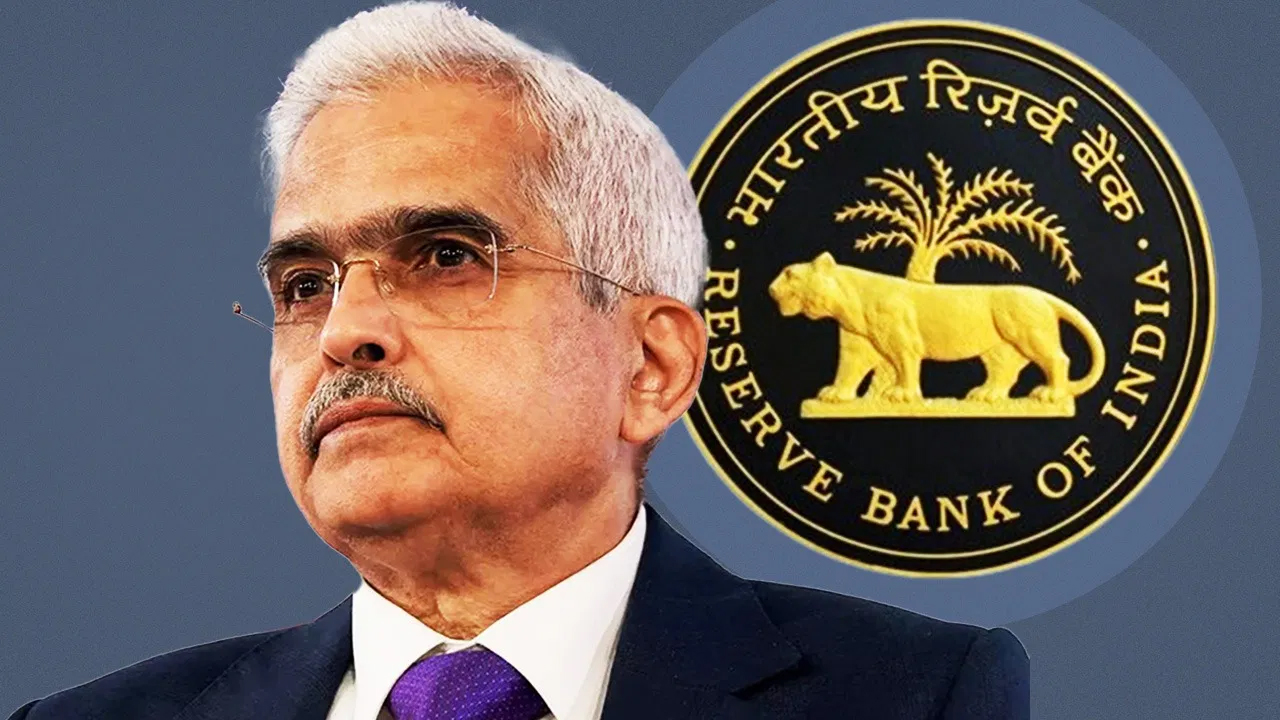

New Delhi: The six-member Financial Coverage Committee (MPC) of the Reserve Financial institution of India (RBI) is scheduled to satisfy on August 6 to eight. It’s prone to maintain the repo price unchanged at 6.5 per cent because of the threat of rising meals inflation. Consultants stated that the six-member MPC can be anticipated to proceed its stance of withdrawing financial coverage rest. Allow us to let you know that the assembly is chaired by RBI Governor Shaktikanta Das. The RBI Governor could announce the committee’s resolution on August 8 at round 10 am.

What’s RBI anticipated to announce within the coverage?

Market specialists stated that the RBI’s rate-setting committee is prone to keep the established order for the ninth consecutive coverage within the financial coverage to be introduced on August 8.

Goldman Sachs stated in a report that the RBI MPC will maintain the coverage repo price unchanged at 6.50 % within the August 8 assembly.

June coverage assembly

Within the June coverage, two exterior members – Ashima Goyal and Jayant R Varma – voted for a 25 foundation factors (bps) lower within the repo price. The speed at which the RBI lends cash to banks. If the RBI adjustments the repo price, it immediately impacts your mortgage.